Read this article on our newly redesigned website here.

This story originally appeared in the March 2017 issue. To subscribe to Louisville Magazine, click here.

Railroad tracks, a creek, a tree-lined four-lane parkway — those operate as obvious lines marking one neighborhood from the next. For most of us, those stand as satisfactory explanations as to how a metropolis can still feel cozy, intimate. This is my ’hood. Urban planners like Joshua Poe need more. The trim 40-year-old with an earnest face and neat goatee may just be kin to the question mark. As a kid, he couldn’t take a ride down a one-way street without wondering, Why is it here? Who decided it was a good idea?

Poe currently works as project manager at YouthBuild, which teaches construction skills to low-income kids, and before that he studied and worked for years as an urban planner in Louisville. In February, he made the media rounds for a project he worked on titled “Redlining Louisville: The History of Race, Class, and Real Estate,” which exposes the city’s redlining maps from the 1930s. Metro government helped Poe with funding to finish the project. And as of last month, the Office of Redevelopment Strategies now hosts the report — complete with interactive maps — on its website.

Redlining refers to the practice of denying loans in certain neighborhoods based heavily on socioeconomic and racial makeup, rather than strictly physical or structural characteristics. It happened in hundreds of cities, big and small. Poe’s project illustrates how many neighborhoods that were targeted for disinvestment now still shoulder poverty, low property values and a greater percentage of mortgage denials than other parts of Jefferson County.

Poe’s curiosity about redlining dates back to 2011, while he was working on his master’s in urban planning. Poe was close to the late J. Blaine Hudson, a longtime University of Louisville educator and prominent voice in the African-American community. Poe recalls how the two would often talk over cigarettes about social justice, segregation and zoning laws that relegate most industrial land and multi-family units to poor neighborhoods.

Hudson urged Poe to the find the redlining maps. It wasn’t easy. Redlining maps were kept private for decades and it has been just within the last few years that scholars have started digitizing them, making them available to the public. The Filson Historical Society, U of L — nobody Poe initially contacted knew where the maps existed. Finally, in 2013, now no longer a student, Poe found them at the National Archives in Washington, D.C. A father of three on a tight budget, and at this point working on the project independently after work hours, he had to borrow the $200 it cost to get copies of the maps sent to Louisville.

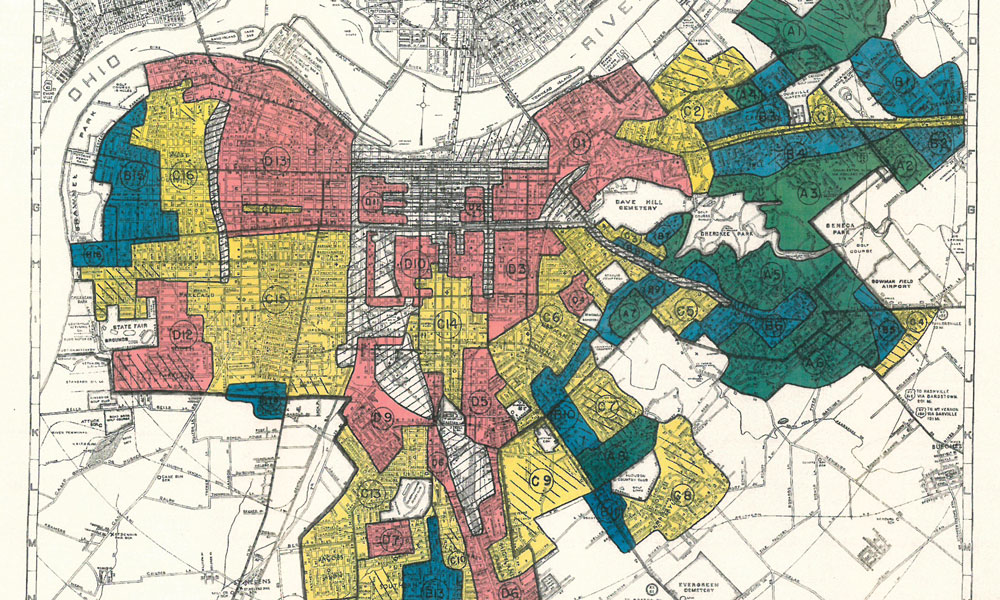

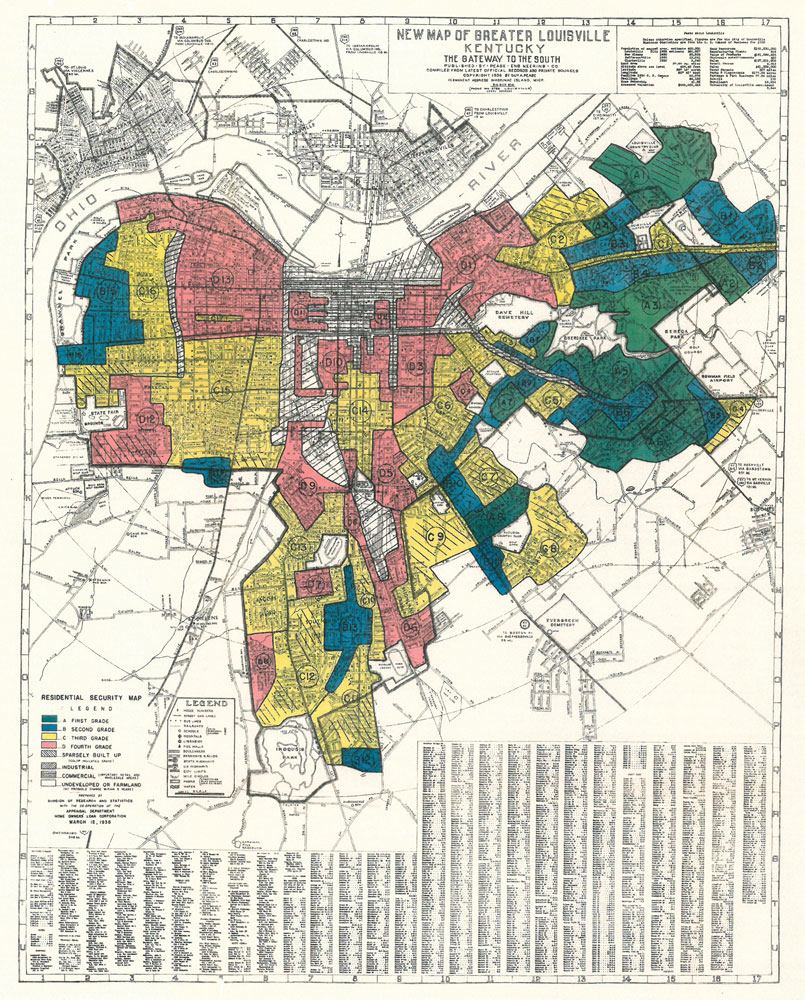

Redlining is in no way the only discriminatory practice in America’s history. But it’s a big one. In 1933, the Home Owner’s Loan Corporation (HOLC) was created to make home ownership more widely available to Americans during the Great Depression. HOLC hired local real-estate experts to create “residential securities maps” to assess risk. Those maps are what are now known as redlining maps. The system ranked and color-coded neighborhoods on a four-tier scale — “A” through “D.” The lowest-quality areas were shaded in a pinkish-red — the color of flushed cheeks — and almost always included predominantly African-American neighborhoods. Banks channeled mortgages away from these zones, making homeownership difficult. Private and public credit institutions, including the Federal Housing Administration, used HOLC’s discriminatory system. Without access to FHA-insured mortgages, black families sometimes relied on predatory lenders.

One afternoon, I interview Gerald Neal, a Democratic state senator who was born in the Beecher Terrace housing project and still lives in west Louisville. When I ask him about redlining, he leans back in his chair. “When you talk about redlining, you got to go way back from the fact that it tended to preserve that which had already existed historically,” Neal says. He’s talking about racism. He’s thinking back to slavery. With that as a foundation, it’s hard to get too upset about redlining. It just maintained racist practices already embedded into the American fabric. (Poe, in his report, points out that for many African-Americans, their first “residence” in Louisville were slave pens at Second and Main streets.) “It’s distressing, because if you raise the issue of race now, and I’m generalizing, but I’d say a majority of society would say, ‘There you go — crybaby,’” Neal says. “But there are consequences. It’s right there in front of us.”

Look at Louisville’s redlining map that dates to 1937. The chunks of red, yellow, blue and green are randomly configured and don’t follow neighborhood boundaries or census tracts. But green and blue, or “A” and “B,” neighborhoods cluster in the east in St. Matthews, Indian Hills and portions of the Highlands. These areas were deemed “hot spots,” full of good housing stock, free of black or Jewish populations (“homogenous”) and not likely to be infiltrated by such populations.

Poe points out that in HOLC’s documents, a neighborhood’s “restrictions” were considered quite valuable. That refers to deed restrictions prohibiting the sales of property to blacks. “These restrictions were mentioned in the assessments more than physical (characteristics) such as the topography or quality of structures,” Poe explains in his report. “For instance, the Indian Hills and Mockingbird Valley neighborhoods were described as the best areas of the city in large part because they were also ‘one of the highest restricted areas.’” (Poe also writes that race seemed to outrank the potential for flooding as a determinant for property values, this at a time when Louisville had just experienced the Great Flood of 1937.)

Top-ranked neighborhoods aren’t exclusively out east. A swath of blue sits next to Shawnee Park, but that area was exclusively white at the time. Stare at the map long enough, a pattern emerges — yellow neighborhoods, or “C”-ranked areas, act as cushions between the areas shaded red and those labeled blue or green.

In yellow-shaded Clifton, there’s a concern of “infiltration . . . of a lower-income group gradually moving in.” Surveyors grew anxious when one class or race mixed with another. Unless they were domestic workers. That was kosher. For instance, in the area of the Highlands near Harvard Drive and Dundee Road, the surveyors wrote that there are “ten negro families, all closely groups and no probability of any further increase in negro infiltration.”

Red clusters include Smoketown, Shelby Park, Russell and Portland (the latter two in the West End). These D-graded areas are summarized like this: “They are characterized as detrimental influences in a pronounced degree, undesirable population or an infiltration of it. Low percentage of home ownership, very poor maintenance . . . unstable incomes of the people . . . areas are broader than the so-called slum districts.” Nails on a chalkboard for mortgage lenders.

A sliver of yellow exists in red Russell. It’s right along Chestnut Street, where a black middle class thrived. It’s the only predominantly black area that received anything but a D-grade. “The area is . . . occupied by negroes and consisting of improvements of better type than those surrounding.” Surveyors touted its proximity to schools and churches. (The strip was demolished in the early ’60s.)

Poe uses 2010 census data (the latest available at the time of his research) to show how redlined neighborhoods stack up now. Russell, Portland and Smoketown all have poverty rates above 40 percent. (Areas around Shawnee and Chickasaw Park that were graded better have lower rates of poverty.) Vacant and abandoned homes plague the redlined areas in greater numbers. Poe also looked at mortgage denials between 2011 and 2013 and found that 41 to 75 percent of mortgage applications were denied in certain areas of Russell and Portland. Smoketown and Shelby Park had a mortgage denial rate of 21 to 31 percent. Out east — Indian Hills, the Highlands, St. Matthews — the rate was 10 to 20 percent.

None of this shocked Poe. But it did unsettle him. “There was a systemic effort to abandon (certain) neighborhoods,” he says. “Redlining became systematic in real-estate market analysis. We don’t call it that. But when we do real-estate market analysis, there’s a demographic study within that.” He uses an example of a grocery store. If a grocery doesn’t like the demographic study of a neighborhood it’s scouting? “It doesn’t build a store there,” he says.

A half-dozen west Louisville baby boomers reunite over strong coffee and homemade ginger cookies. A few minutes in, it’s a loose thread of happy memories — We lived in that pink little house after you! I used to sit in my tree house and watch the horse races! There were so many officers on my street we called it the 41st Street precinct! You remember when Southwestern Parkway was called Black Hollywood?

Everyone grew up in or near the Westover subdivision, now Chickasaw, a part of west Louisville that sat near a horse track, the old fairgrounds and a Ford plant. The group, which includes Metro Councilwoman Cheri Bryant Hamilton, has assembled at Leborah Goodwin’s house on Plato Terrace to talk with me about the effects of redlining on African-Americans. I was expecting sour tales of their parents struggling to purchase a home. I was wrong.

Image: Remembering Westover (from left to right): Carol Ray Bottoms, Michelle McCrary, Cheri Bryant Hamilton

and Lynn McCrary talk about growing up in west Louisville; by Mickie WInters

Lynn McCrary, a tall, outgoing woman with gray hair that sits like a crown, pulls the original deed to her parents’ home out of a tote bag — a tote, I might add, that’s an impressive archive of deeds, insurance papers and brochures from Martin Luther King Jr.’s visits to Kentucky. She passes the deed around.

“There’s my granddaddy’s name!” Carol Ray Bottoms exclaims, gleefully. Her grandfather — Joseph Reynolds Ray Sr. — was a prominent banker and real-estate developer who helped black families purchase homes. (President Dwight Eisenhower appointed him assistant to the administrator of the Housing and Home Finance Administration.) Bottoms’ grandfather helped McCrary’s parents buy a home on Grand Avenue in May 1946.

“Get the court case!” Hamilton instructs.

Goodwin makes copies of a Court of Appeals decision from 1943 and hands them to the group. The case stems from a 1939 dispute. Joseph Ray was among a group of developers interested in building homes on land they had purchased near Chickasaw Park. Whites in the neighborhood fought to prevent it.

Hamilton reads out loud from the decision: “When questioned, Mr. Ray stated for the past 15 years the colored people of Louisville have been faced with the problem of new and better homes. Despite the fact that several thousand new FHA homes have been built in and around the city, less than 50 are for colored. The reason being that suitable locations could not be obtained. The acquiring of Westover subdivision . . . seems to be a partial solution to the problem.” The ruling goes on to say “no shacks, but only respectable types of homes will be built as a credit to the colored people and to that section of the city.” A victory.

“Wow,” somebody says. The room seems to sigh.

The group remembers other businessmen who helped black families buy homes and raise kids who went on to become lawyers, judges and councilmembers. “This is like Hidden Figures!” Goodwin exclaims, referring to the recent film about the unrecognized African-American female mathematicians who played a pivotal role during the early years of NASA.

But discrimination lived. Bottoms, an elegant woman with a bob hairdo and stylish glasses, recalls helping her grandfather and father in the real-estate business. “I used to fill out the contracts, that was my job, and I remember a family, they both were teachers and only had one child, and I remember doing a letter that said they would not have any more children if they could secure a loan,” she says. The room murmurs another “wow.” “I typed a letter and I think my daddy scribbled some doctor’s name on it and we said she wouldn’t have another kid.” (Bottoms says the woman did end up having another child years later.)

Many in the room detail a resistance, a way around barriers to homeownership. Mammoth Insurance Company and Domestic Life and Accident Insurance Company, both black-owned businesses on lively Walnut Street (then dubbed “Louisville’s Harlem” and now Muhammad Ali Boulevard), provided home insurance. “They (also) held a lot of loans for people’s houses,” Bottoms says. “People may not realize that, but they were the mortgage holders on a lot of the houses.”

Officially, redlining ended in 1951. But a few years later, Louisville, and many other cities, would participate in urban renewal. Its nickname in black communities —negro removal — strips any euphemism. Walnut Street, the beloved strip of movie theaters, nightclubs, shops and banks, was torn down. Many businesses that couldn’t afford to relocate closed. “What came next?” Bottoms asks rhetorically. “They called it block busting?” In the early ’60s, as thousands of whites fled west Louisville for suburbs in the east and south, realtors often pressured white families to move if just one black family moved in, convincing whites their property values would go down.

Bottoms recalls one instance when her father drove by a home for sale that clients of his might have been interested in. When he saw it was a white family selling the home, he drove on, fairly confident that the white family who had listed the home was mad at a neighbor and, as payback, was trying to get a black family to move in. Some concerned citizens — both black and white — formed the West End Community Council in an effort to curb white flight. It didn’t work.

I ask the group for their thoughts on redlining’s lasting effects. Most look to Hamilton for her take. She pauses. “It’s more than redlining,” she says. “I see the disinvestment. When people left, they took their dollars with them. They took their businesses with them. Jobs left — Philip Morris and National Tobacco. Then, there were no jobs. It just got rougher.”

Hamilton’s big crusade as councilwoman for the last few years has been combatting absentee landlords and unregulated halfway houses. She remembers her Westover neighborhood as quaint — everyone knew each other, lawns were manicured and flowers blossomed in the spring. “Not fake flowers,” she says, flatly. Hamilton wants that back for all of west Louisville. As the sun sets over the Ohio River less than half a mile away, pink light creeps into the blue sky. The group will splinter and head home soon. But first McCrary talks about friends of hers who wanted to move to west Louisville. “Her bank didn’t want her to mortgage in the West End,” she says. “She got approved for Shively.”

“They’ll steer you away from the West End,” Hamilton says. I ask for clarification. Realtors? Lenders? Recruiters? Many in the room just nod.

Anecdotes can be flimsy. So I Google “redlining” and “lawsuit.” There’s a lot of proof that housing discrimination is alive. In 1997, a Louisville-based insurance agent with Nationwide Insurance Company claimed Nationwide’s managers would not allow him to write policies in Louisville’s predominantly black West End, providing him with a map of the city that had a red-ink circle around west Louisville and an X through it. J. Bruce Miller represented the agent and, due to a nondisclosure agreement, can’t detail how the suit was settled, but Miller says the agent received a “substantial settlement.” The agent had quit before filing the suit and took the map with him. Once Nationwide realized that, Miller says, “the proverbial stuff hit the fan.”

More recently, in January, the U.S. Department of Justice filed a lawsuit against a Minnesota bank that allegedly avoided serving individuals seeking mortgage loans in minority-heavy census tracts. In 2015, the Department of Housing and Urban Development settled with the largest bank in Wisconsin over claims it discriminated against black and Hispanic borrowers throughout the Midwest from 2008-2010. And data from the Home Mortgage Disclosure Act shows that in Jefferson County in 2014, 29 percent of African-Americans who applied for a mortgage were denied versus 18 percent of white applicants. There are also legal cases related to inflated insurance rates for minorities throughout the country. Those in the insurance industry will maintain they don’t care about race but, in the case of housing-insurance policies, take into account factors like the age of a home, its condition and crime in the area. Mortgage lenders would echo that in some shape or form.

The Fair Housing Act of 1968 was created to put an end to preferential treatment. And it helped. But Poe argues that redlining’s legacy endures. Banks and businesses don’t want to lose money, so they size up communities. “The fair-housing laws were really ineffectual because it became a part of the structure,” Poe says. “It became part of the design.”

Last month when the city announced the redlining project before television cameras and social-justice advocates, Jeana Dunlap, the director of the Office of Redevelopment Strategies, encouraged Louisvillians to take a look at the maps, to wrestle with the uncomfortable a bit. Struggling neighborhoods, Dunlap said, didn’t just suffer from bad luck. “Today is an opportunity to begin talking openly about many of the systematic and institutional challenges faced by everyday people trying to get ahead,” Dunlap said. “Some of our neighborhoods need basic services or amenities that may be taken for granted in other areas of town.”

After her presentation, a man in the audience asked, “What actions might result from this?”

At first, Dunlap’s answer unraveled in bureaucratic order, with talk of looking for best practices in other cities and wanting to engage the community. Then she shifted.

“No, I don’t have an answer to that question,” she said. “And that’s exactly why the dialogue is so desperately needed.”

To look at Josh Poe’s redlining project or to learn more about the city’s series of community meetings about redlining, click here to read about “Redlining Community Dialogue.”

This story originally appeared in the March 2017 issue. To subscribe to Louisville Magazine, click here.